This article is Part 1 of a 3-part series discussing how investors can avoid acting irrationally. Read Part 2 and Part 3.

The stock market is not your friend. You want to approach it the same way the American president should approach a one-on-one meeting with the Russian president: Be respectful but cautious. He might smile at you and say all the right things, but despite the diplomatic niceties, your interests might not be aligned.

The stock market awakens a dangerous emotion: fear. It is sitting dormant in us all, awaiting an excuse to wake up. When stocks are going up, we may find ourselves engulfed in the fear of missing out (which is so predominant in our society that we even have an acronym for it – FOMO). When we are consumed by FOMO our time horizon magically expands. We tell ourselves we are long-term investors and our risk tolerance is infinite. Risk of decline? We puff out our chests and say “bring it on!”

And then when the market actually declines, a very different fear pays us a visit–the fear of loss. The invincible hero who conquered the FOMO moment shrivels to a husk of his former self when the fear of loss emerges. The chest collapses, and so does the time horizon, shrinking from “years and years” to months, days, or minutes.

These two fears are not compatible with successful investing and have a zero-sum relationship with rational decisions. The more you are dominated by these fears, the less rational you are.

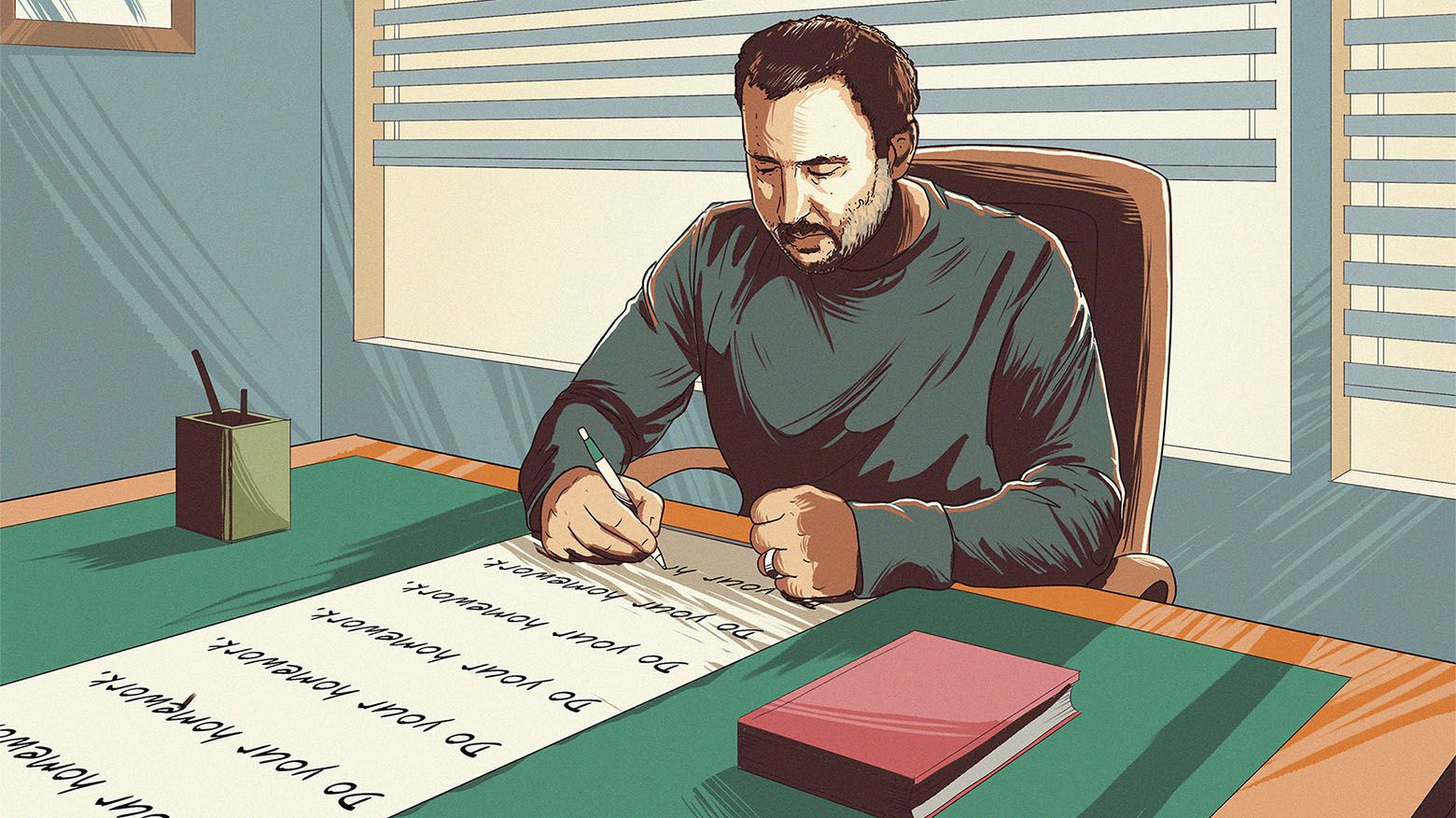

Think of the total skill set of an investor as a multivariate equation in which all our skills are combined: the ability to value companies, to interpret financial statements, to understand and apply macro- and microeconomics, to be an independent and creative thinker, etc.

And then that grand sum must be multiplied by your ability to remain rational. Think of your ability to remain rational as a number between 0 and 1. If you are totally rational, you are a 1.

If you let the emotions generated by the last tick of the market seep into your investment process and dominate your buy and sell decisions, then it won’t really matter what the sum of your other skills is. That sum will be multiplied by a big fat zero, and thus your total skill level as an investor will be exactly that – yes, zero. You’ll be doing what the average investor does – buying high and selling low.

Thus, rationality is one of the most important qualities I’d be looking for in a money manager. Recent market volatility – a code word for when the market doesn’t just go up but also declines – makes the rationality discussion even more pertinent.

Staying rational is a very proactive, not a reactive, journey. Smart investors deliberately structure their lives and design our investment process to protect us from the toxicity of the market. The more you let the stock market into your life unguarded, the more room you create for fear – and the more your rationality slips from one toward zero.

0 comments